Swing Trading

Swing trading is a trading style where you hold positions for several days to a few weeks to profit from short- to medium-term price swings in the market.

Key features of swing trading

-

Time frame: Days to weeks

-

Trades per week: Low to moderate

-

Markets: Stocks, ETFs, options, forex, crypto

-

Analysis used: Mostly technical analysis, sometimes fundamentals

-

Monitoring: Not constant—positions are held overnight

How swing traders make money:

Swing traders try to:

-

Buy near support and sell near resistance

-

Enter trends early and exit before momentum fades

-

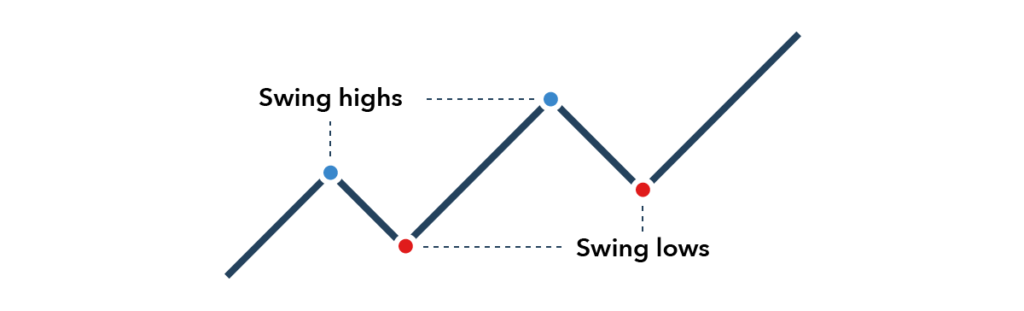

Capture a “swing” within a larger market move

Trading strategies for swing trading can be classified as:

- Trend Following

- Momentum

- Breakout

- Mean Reversion

Common swing trading strategies

-

Trend pullbacks: Buy dips in an uptrend

-

Breakouts: Enter when price breaks key levels

-

Reversals: Trade when momentum shifts

-

Moving average strategies: Using 20-, 50-, or 200-day MAs

Risks

-

Overnight risk: News can move prices while markets are closed

-

False signals: Breakouts can fail

-

Market reversals: Trends don’t always last

Swing trading vs day trading

| Swing Trading | Day Trading |

|---|---|

| Days to weeks | Same day only |

| Fewer trades | Many trades per day |

| Less stress | Very fast-paced |

| Can be done part-time | Usually full-time |

| Lower fees | Higher fees |

Bottom line

Swing trading is often considered more beginner-friendly than day trading because it’s slower, requires less screen time, and allows more time to make decisions—but it still involves risk.